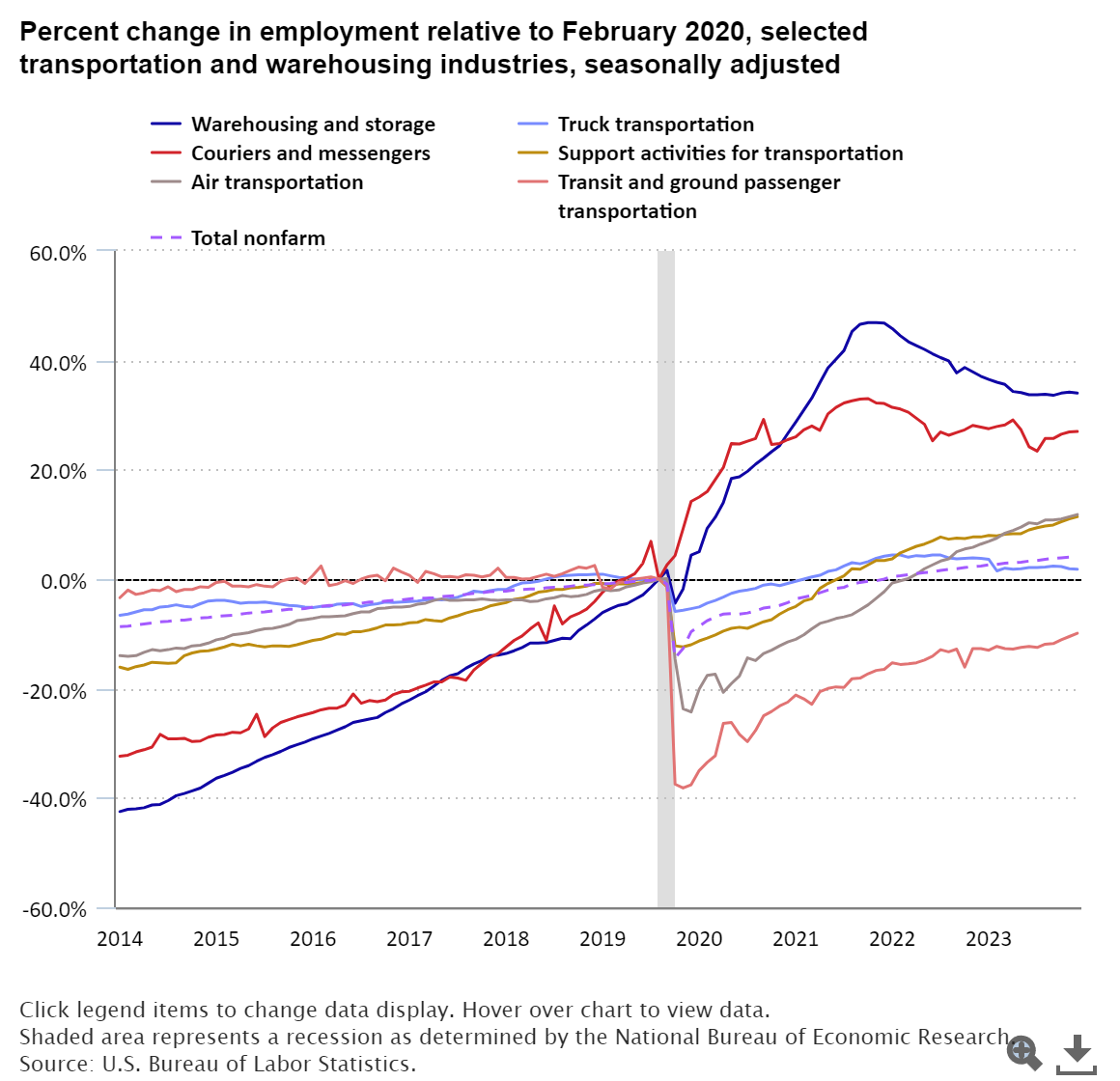

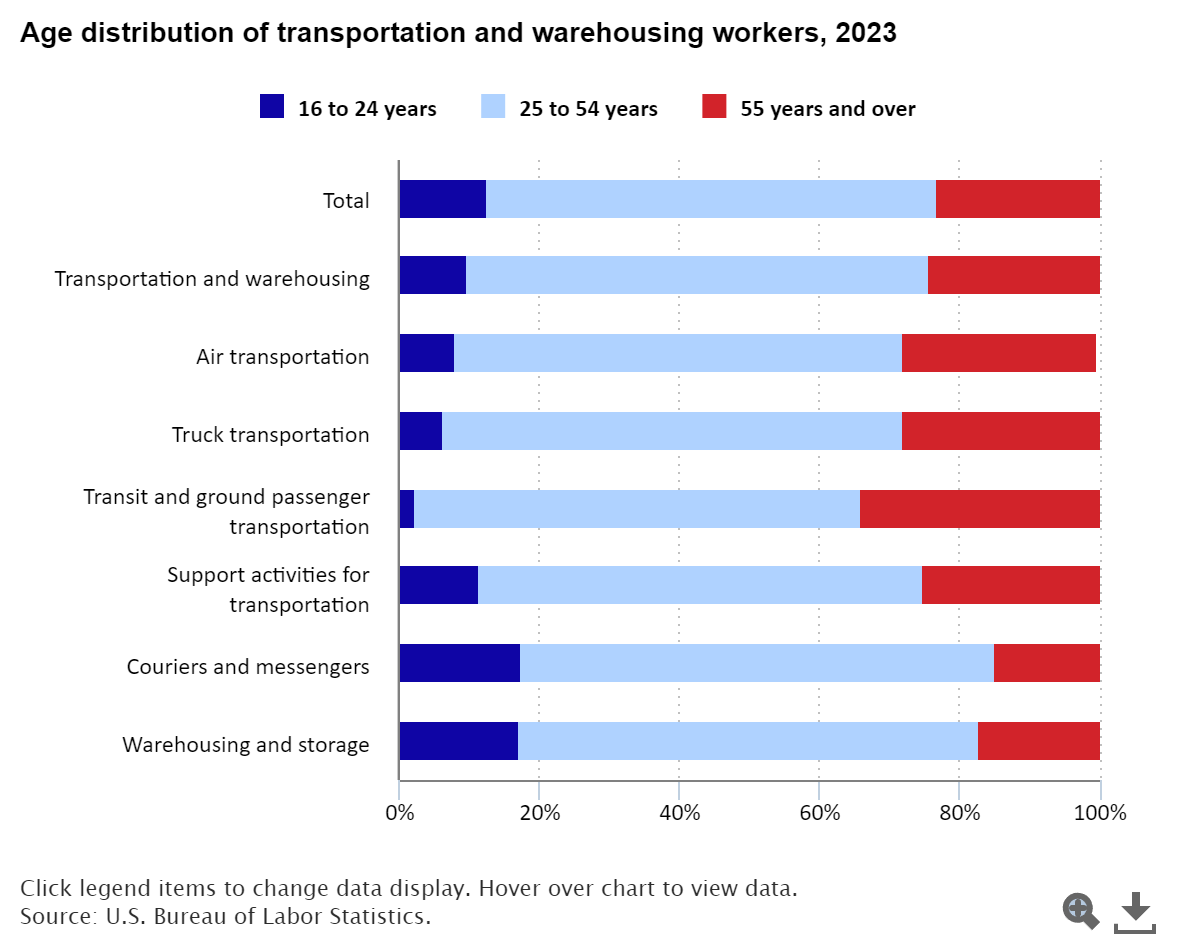

The charts above from the U.S. Department of Labor clearly indicate the significant changes in the labor force we can anticipate in the next several years. They say that to be forearmed is to be forewarned. Fortunately, SC Codeworks’ advanced WMS can significantly reduce your labor downtime with the revolutionary concept of automated workflow. We can show you how this will lead your operations to greater efficiency.

The Impact of Rising Warehouse Rents on Supply Chains & 3PLs

While the number of job openings in many sectors including warehousing and transportation have been steady decreasing, the number of qualified applicants as defined by actual new hires have also decreased, and any gains are generally canceled out by a nearly equal number of separations. Still employment in warehousing is expected to outpace labor force growth in the next several years.

Consider this statement by the U.S. Chamber of Commerce, “The COVID-19 pandemic caused a major disruption in America’s labor force—something many have referred to as "The Great Resignation." In 2022, more than 50 million workers quit their jobs, following the 47.8 million who did so in 2021. In 2023, this trend gradually subsided, with 30.5 million workers resigning as of August.

A closer look at what has happened to the labor force can be better described as "The Great Reshuffle." While quit rates remain high, hiring rates continue to outpace them as many workers have been transitioning to other jobs in search of an improved work-life balance and flexibility, increased compensation, or a strong company culture.

What will your operation look like next year or the year after that? Begin with the end in mind.

- Picture a full and perfect roster of employees that show up on time every day, and make no mistakes, operating like a crack team of seasoned veterans; like a well-oiled machine. Now come back to reality and imagine what kind of tools you could provide to your current work force that would mitigate and cushion the likelihood of unexpected illness, absence, or human errors. Tools are what make warehousing possible. Leveraging ever improving technology is just a decision to use better tools.

- While it is estimated that warehouse picking rate errors can range from 1%-2% and overall error rates within warehouse and 3PL operations can average from 2%-4%. The tremendous financial impact on a company’s profitability is often less obvious. Some might say, “It’s just the cost of doing business,” It doesn’t have to be.

- Everyone has heard the tired, old adage that, “People don’t generally plan to fail, they simply fail to plan.” It’s a clever turn of phrase, but it can be a sad reality with devastating outcomes for those who fail to heed its inherent wisdom. Any labor force plan should include automation, not only as an option, but as a foundation.

The Impact of Automation on Warehouse and 3PL Workforce

In the fast-paced world of logistics, the integration of automation into labor workflows is revolutionizing warehouse and third-party logistics (3PL) operations

Here’s how:

- Reducing Cost of Downtime Every minute of downtime in a warehouse is costly. Automation helps to maximize the limited number of hours in a day, ensuring that operations run smoothly and continuously. This uninterrupted workflow is crucial for maintaining productivity and meeting deadlines.

- Enhancing Competitiveness By lowering overall costs, automation allows warehouses and 3PL providers to be more competitive. Customers benefit from reduced expenses, which in turn can lead to increased business and profitability. Given the current consumer outcry against runaway inflation, this cannot be overstated as a primary reason to invest in an affordably priced, customizable, and scalable WMS, especially one with superior labor force workflow capabilities, such as SC Codeworks has pioneered.

- Keeping Employees on the Move Automated systems keep employees moving by reducing internal wait times. This not only increases employee satisfaction but also lowers frustration and spreads the workload more evenly. Workers can focus on tasks that require human intervention, while machines handle the repetitive aspects of the job.

- Mitigating Risks Tight turnaround times and high transportation costs amplify the risks associated with manual operations. Automation lowers the chance of misplaced products and errors, which can be costly and damage customer relationships.

- Driving Operations Forward With automation, warehouses and 3PL operations can handle higher volumes of goods. This scalability is essential for growth and can significantly improve on-time shipping key performance indicators (KPIs), which are vital for customer satisfaction and retention.

Conclusion

- While the cost and inevitable implementation challenges of integrating a new WMS into your current operations may initially seem daunting, the cost of failing to do so may be the real pain you should strive to avoid. An affordably priced WMS can still provide the level of sophistication necessary to operate a growing warehouse or 3PL enterprise.

- Whichever WMS you choose, it should remove any questions your team has surrounding “what is our workload?” It should also give you visibility into your day, while increasing your worker satisfaction and productivity. It should be fully integrable, customizable, flexible, and most importantly scalable.

- Hiring and empowering the right people can make or break your logistics or 3PL business. One of the best ways to empower a dedicated workforce to produce more with less effort is to provide them with the proper tools. Telling them to “Work smarter not harder,” will only get you so far. Use whichever metaphor works for you, whether it’s properly equipping the military before a major operation or donating high quality uniforms, shoulder pads and helmets to the local little league football team before the new season, nobody wants to go into battle ill-equipped.

What to do Next

Our expert implementation team stands ready to discuss whether your operation could realize any or all of the benefits of operations automation. It starts with a phone call, a conversation, some information exchange, an online demonstration and then if appropriate a site visit. In the worst-case scenario, you have met and conversed with industry experts whose singular goal is to improve your operations and your bottom lineAlternately you might begin a business relationship that positively impacts you and your employees for years to come. Why not make the call today?